By Harry Mottram: It comes as no surprise that the numbers of firms going bust is skyrocketing. ICSM’s Ian Carrotte said: “In years to come it is possible that the years 2023-2025 will be seen as the hangover years following a perfect storm of problems for the UK economy. Historic debt, Covid shutdowns, Russian-Ukraine War, Israel-Gaza War, a faltering economy in China, quantitative easing, the switch from carbon products to so-called sustainables, high interest rates and high inflation, the impact of the Brexit business deal, and the Liz Truss-Kwasi Kwarteng mini budget to name but a few have all created a flat lining economy.”

David Kelly, Head of Insolvency at PwC said: “Today’s data shows there were 1,967 corporate insolvencies in September – a 17% increase on the same month last year and down from the 2,308 insolvencies in August. While this dip is welcome, we expect the respite to be short-lived, with the UK remaining on track for the highest number of insolvencies since 2009.

“The challenging economic climate continues to impact companies across a range of sectors. Construction is being particularly hard hit, suffering more insolvencies than any other sector, while retail and hospitality and leisure continue to struggle. Indeed, restaurant closures have sadly reached the highest level in a decade.

“Although the recent pause in interest rates is welcome news for businesses needing to refinance their loans, it will still be more expensive to do so and the process is likely to be more difficult, which will have an impact on both cash flow and profits. Unfortunately, it’s therefore likely that the number of companies falling into insolvency will remain high over the coming months.”

Catherine Atkinson, Director in PwC’s Restructuring and Insolvency practice said: “Compulsory liquidations remained high in September with 469 petitions by creditors to wind up companies. This compares to 398 this time last year, and is above the monthly average for 2023 of 407, according to our analysis.

“Despite the recent fall in the inflation rate it remains significantly above the long term average. External conditions remain very difficult for many companies who are having to juggle sustained increases in operational costs; worries about consumer demand; and challenging market conditions alongside increased borrowing costs. We expect that insolvency levels will remain high and that creditors will continue to take action to recover outstanding debts by petitioning to wind up struggling companies.”

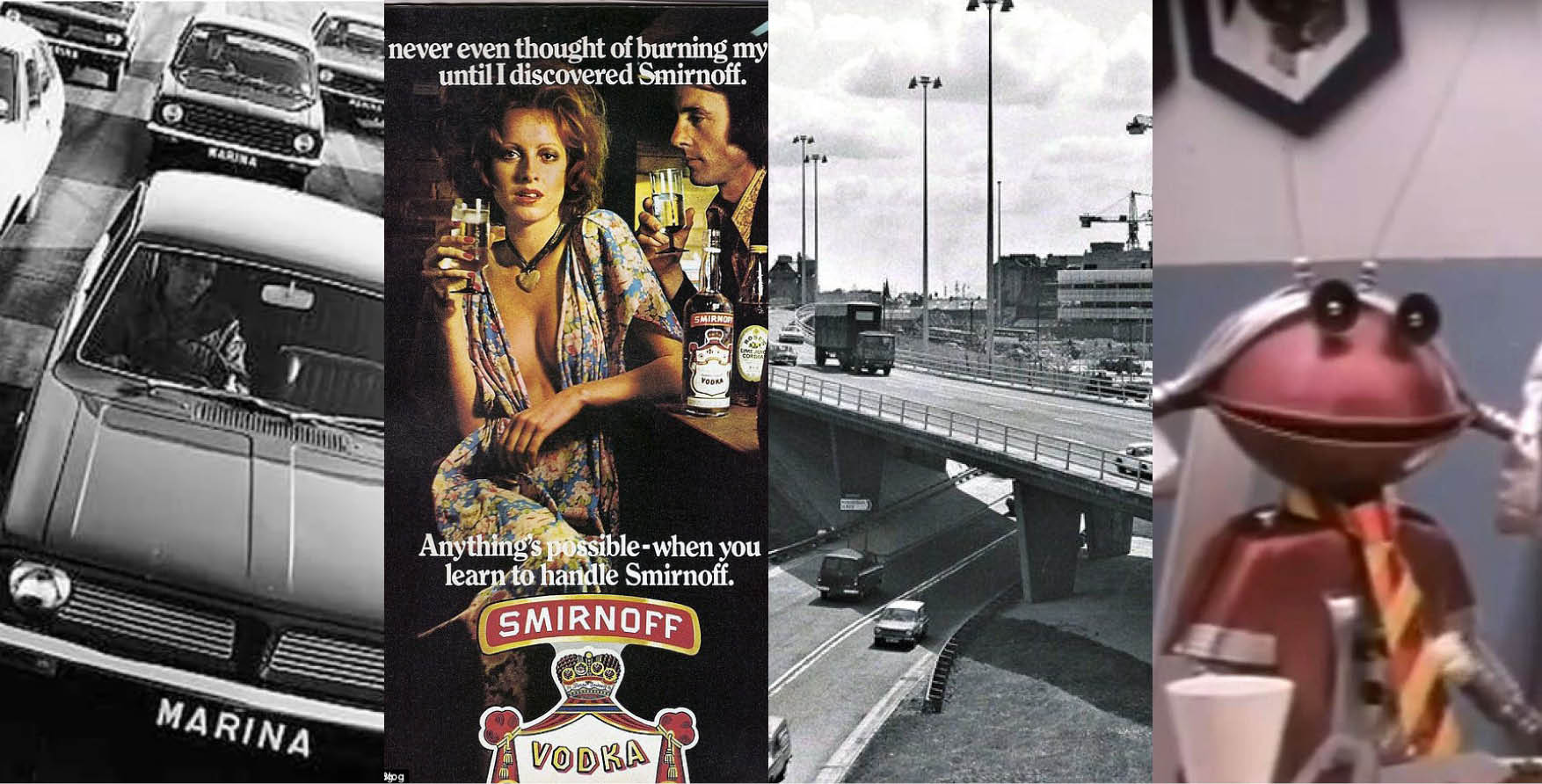

ICSM’s Ian Carrotte said: “However, despite these challenges the UK and most western economies are very resilient as they are complex with a wide range of sectors. Even in the gloomiest of times some industry sectors do well which helps to bouy up the economy as a whole. Take the 1970s when oil exploration in the North Sea boosted the Scottish economy, advertising agencies enjoyed they golden period, and when motorways were being built across the country and despite the strikes car manufacturing was higher than any decade since until now, when finally the numbers (thanks in part to 4x4s and e-cars) are up.

“Do the insolvency figures herald a recession or a further flat lining of the economy – we will have to wait and see but certainly times are tough but like the 1970s when things flatlined some will do well. Those who have minimised debt, kept ahead with the technology and with industry trends tend not to feature so much in those depressing insolvency figures.”

+++++++++++++++++++++++++++++++++++

ICSM CREDIT

For information on ICSM visit www.icsmcredit.com or call 0844 854 1850.

ICSM, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR. Tel: 0844 854 1850. www.icsmcredit.com. Ian.carrotte@icsmcredit.com