By Harry Mottram: In any normal capitalist market economy Chinese property giant Evergrande with around £300 billion pounds in debt would have gone bust years ago but the Government of the so-called People’s Republic doesn’t play the normal rules of business. Ever since Evergrande defaulted on repayment of loans two years ago the largest property company in the country has been insolvent, reneging on repaying loans, failing to complete building projects and ripping off suppliers by not paying them and taking cash from home buyers for properties not built. And there’s the small matter of Evergrande’s portfolio in the UK which includes millions of pounds of real estate in London such as those in Rutland Gate (that’s seen its for sale price slip by £50m in a fire sale and still no takers at £200m), while other Chinese investors in the UK will and are being spooked at the collapse of Evergrande.

Pic: New York Times. Evergrande workers were pressured to give up bonuses and invest in the company – only to lose everything

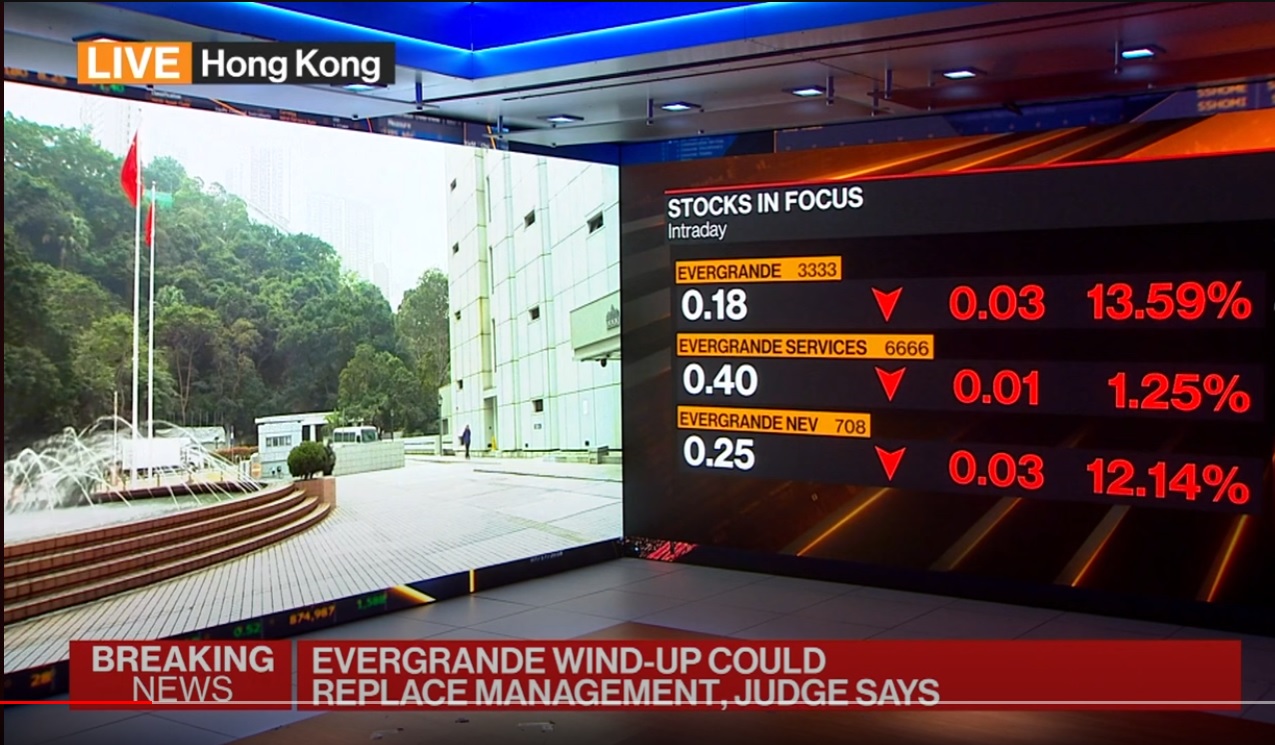

Being China however the normal rules of business don’t apply as the command economy mentality of the one-party state run by billionaires can’t allow the firm to fail. A judge in Hong Kong ordered the enclave’s division to be liquidated which technically would mean the mainland division where most of the assets are should follow suit since it is insolvent. And here’s the catch – not so it would seem, as the Chinese Government is keen to keep the outfit afloat in part to see people and companies repaid and in part national esteem and fear of losing face and more importantly plunging the country into the unthinkable: a recession.

Building sites across China are lying half completed as Evergrande struggles to stay in business

The USA subsidiary of Evergrande has filed for Chapter 11 bankruptcy protection while trading in the Honk Kong shares have been suspended following a collapse in their price. Last year its chairman and other top executives were detained by the Chinese authorities – in other words things are bleak. So what does this mean for the UK you may ask. The main fall-out will be with the banks who have lent cash to Evergrande who won’t get paid – BlackRock are owed according to Reuters at least £3billion pounds, HSBC are in for an undisclosed some thought to be north of one billion pounds while lenders Standard Chartered, Fidelity, Pimco, and Allianz are all on the list who may never see a penny. That may be their problem, but it could be a Lehman Brothers moment with all the other banks cutting their lending creating a new Credit Crunch. Depending on who you listen to Evergrande represents up to a third of China’s GDP. That could mean firms in the UK finding lending restricted and interest rates not falling as hoped. That’s a problem not only for business but also for the UK economy. Chinese banks, investors and businesses reliant on the property giant will be hit and may well scale back business – both in the People’s Republic but here in Britain. Like 2008’s Credit Crunch that could well lead to a further fall in investment in new development and the effect on suppliers. That means everyone such as builders, printers, solicitors, window cleaners, couriers and sign makers all losing work and potentially not getting paid for what they’ve already done.

+++++++++++++++++++++++++++

++++++++++++++++++++++++++++

ICSM CREDIT

For information on ICSM visit www.icsmcredit.com or call 0844 854 1850.

ICSM, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR. Tel: 0844 854 1850. www.icsmcredit.com. Ian.carrotte@icsmcredit.com