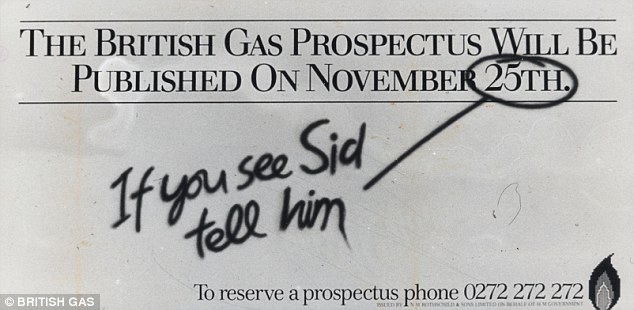

By Harry Mottram: Older readers may recall the advertising campaign in the 1980s ‘Tell Sid’, extolling the virtues of buying shares in the newly privatised British Gas. The doctrine of the time was that by privatising water, electricity, gas, the railways and British Telecom would give customers greater choice, lower prices and increase efficiency. Initially that was true but since those heady days the questions have come thick and fast. In particular the question over who owns those utilities and whether the British public get a better deal than they did before the sell offs. With a public perception that they are often badly run, that the watchdogs are toothless and prices are just as high as before then it is no surprise that the current government is committed to bringing rail back into public ownership and the voices demanding the utilities are also nationalised will keep growing louder.

Failed Rebel

Around 90,000 customers of Rebel Energy were without a new supplier when the Bedford company went bust last month although they have been assured they will be switched automatically to British Gas. As such customers shouldn’t see any change other than their future bills will come from the British Gas – one of the big six energy giants – the others being EDF Energy, E. ON, nPower, ScottishPower, and SSE.

Tim Jarvis, director general for markets at Ofgem, said all credit balances would be carried over. “While I know customers may be concerned, they do not need to worry,” he said. “Rebel Energy customers will be placed onto a competitive tariff, though should consider what’s right for them once the transfer is complete. They will also face no exit fees if they choose to switch to another supplier.”

There have been persistent questions raised in the media and in politics about the wisdom of privatising the state-owned gas and electricity companies in 1986 and 1990 by Margaret Thatcher’s Conservative Government. Around six million people have seen their new privately owned energy supplier go bust since then leading to massive unpaid debts to the suppliers and lenders to these firms. More than 50 firms have gone to wall with 2021 seeing 28 energy suppliers crashing creating a headache for Ofgem who had to ensure that customers were not cut off.

The Energy Shop provide this list of failed energy firms:

| Energy Supplier | When | No. of Customers | New Supplier |

|---|---|---|---|

| Rebel Energy | 01/04/2025 | 90,000 | British Gas |

| Whoop Energy | 18/02/2022 | 262 | Yu Energy |

| Xcel Power Ltd | 18/02/2022 | 274 | Yu Energy |

| Together Energy (inc Bristol Energy) | 18/01/2022 | 176,000 | British Gas |

| Zog Energy | 01/12/2021 | 11,700 | EDF Energy |

| Orbit Energy | 25/11/2021 | 65,000 | Scottish Power |

| Entice Energy | 25/11/2021 | 5,400 | Scottish Power |

| Bulb Energy | 22/11/2021 | 1,700,000 | Special Administration Process |

| Social Energy Supply | 16/11/2021 | 5,500 | British Gas |

| Neon Reef | 16/11/2021 | 30,000 | British Gas |

| CNG Energy | 04/11/2021 | 41,000 (Business) | Pozitive Energy |

| Zebra Power | 02/11/2021 | 14,800 | British Gas |

| Omni Energy Ltd | 02/11/2021 | 6,000 | Utilita |

| Ampoweruk Ltd | 02/11/2021 | 600 + 2000 (Business) | Yu Energy |

| MA Energy | 02/11/2021 | 300 (Business) | SmartestEnergy |

| Bluegreen Energy | 02/11/2021 | 5,900 | British Gas |

| GOTO Energy | 18/10/2021 | 22,000 | Shell Energy |

| Daligas | 14/10/2021 | 9,000 | Shell Energy |

| Pure Planet | 13/10/2021 | 235,000 | Shell Energy |

| Colorado Energy | 13/10/2021 | 15,000 | Shell Energy |

| Igloo Energy | 29/09/2021 | 179,000 | E.ON |

| Symbio Energy | 29/09/2021 | 48,000 | E.ON |

| ENSTROGA | 29/09/2021 | 6,000 | E.ON |

| Avro Energy | 22/09/2021 | 580,000 | Octopus Energy |

| Green | 22/09/2021 | 255,000 | Shell Energy |

| Utility Point | 14/09/2021 | 220,000 | EDF Energy |

| People’s Energy | 14/09/2021 | 350,000 | British Gas |

| PFP Energy | 07/09/2021 | 80,000 | British Gas |

| Money Plus Energy Ltd | 07/09/2021 | 9,000 | British Gas |

| Hub Energy | 09/08/2021 | 6,000 | E.ON |

| Green Network Energy | 27/01/2021 | 360,000 | EDF Energy |

| Simplicity Energy | 27/01/2021 | 50,000 | British Gas |

| Yorkshire Energy | 02/12/2020 | 74,000 | Scottish Power |

| Tonik Energy | 06/10/2020 | 130,000 | Scottish Power |

| Go Effortless Energy | 03/09/2020 | 2,500 | Octopus Energy |

| GnERGY | 18/03/2020 | 9,000 | Bulb Energy |

| Breeze Energy | 18/12/2019 | 18,000 | British Gas |

| Toto Energy | 18/12/2019 | 134,000 | EDF Energy |

| Uttily Energy | 15/10/2019 | 280 (Business) | Total Gas and Power |

| Eversmart Energy | 06/09/2019 | 29,000 | Utilita |

| Solarplicity | 13/08/2019 | 7,500 | SSE |

| Cardiff Energy Supply | 09/08/2019 | 800 | SSE |

| Brilliant Energy | 11/03/2019 | 17,000 | SSE |

| Our Power | 25/01/2019 | 31,000 | Utilita |

| Economy Energy | 08/01/2019 | 235,000 | Ovo Energy |

| One Select | 10/12/2018 | 36,000 | Together Energy |

| Spark Energy | 10/12/2018 | 290,000 | Ovo Energy |

| Extra Energy | 21/11/2018 | 108,000 | Scottish Power |

| Usio Energy | 15/10/2018 | 7,000 | First Utility |

| Gen4U | 13/09/2018 | 500 | Octopus Energy |

| Iresa | 13/09/2018 | 90,000 | Octopus Energy |

| National Gas and Power Limited | 25/07/2018 | 22,000 | Hudson Energy |

| Future Energy | 13/09/2018 | 170,000 | Green Star Energy |

Dirty Water

The collective wisdom amongst those in the water industry and its backers is that there is no way Thames Water can be prevented from eventual insolvency and public ownership due to its debt mountain. In the meantime nobody wants it to go bust – including the Government – as it not only would the lenders and banks come crashing down with it but the public would end up footing the bill. Critics say (and they have a point looking at the domestic hikes in consumer water bills) they are already paying for the mismanagement and alleged asset stripping. Afterall goes the argument it was debt free when it was privatised.

The embattled water supplier has gained the overwhelming backing of its creditors this month for its second consent request for its debt restructuring plans. Now it will begin the process for the second tranche of super senior funding, which will allow it more time to find a long-term solution to its ongoing financial crisis. Reuters have reported: “It had to seek permission from its creditors to draw down the second tranche of funding to be provided in May. The Second Consent Requests was approved by 94.58% of Super Senior Issuer Secured Credit Participations. The total consent rate, which includes deemed consent, was 98.78%.”

The boss of the water utility Adrian Montague explained to MPs in the environment select committee this week that the firm has been days away from insolvency earlier this year and the current negotiations would buy it time. With a £19bn debt mountain just servicing that figure drains away any chance of it ever breaking even. With 16 million customers and 8,000 employees many will be wondering how much longer its drawn out death throws can continue. ICSM has repeatedly raised questions over the payment of the scores of contractors engaged by the business and the long list of suppliers – all of which must be wondering if the worst happens will they be paid.

Ferry Bad Business

In 2022 P&O sacked 800 workers and replaced them with low paid staff claiming it would go out of business if it didn’t The troubled ferry company is again in the spotlight as it has failed to publish its accounts for several months suggesting all is not well with MPS in Parliament demanding it appear before them to explain what is going on.

ICSM reported as the time of the mass sackings the firms shaky financial health with hundreds of millions of pounds worth of debt, competition from rivals for the lucrative cross-channel trade and the effects of cheap flights and the Eurostar train service to the Continent it has for roll-on-roll-off ferries. The Government however may have misgivings over P&O’s business ethics but publicly give the firm a free pass for fear their owners dubai-based DP World pull out of investing £1bn in the London Gateway container port.

ITV News have reported on the concerns and have quoted the words of Richard Murphy, Emeritus Professor of Accounting Practice at Sheffield University Management School and a former chartered accountant with KPMG. He has studied the language of excuses for the delays from their accountants KPMG suggesting there’s a major problem over the management of the ferry business. In response P&O said: “We thank KPMG for their services as our auditors, P&O Ferries is focused on filing our 2023 accounts as soon as possible. The business is making a strong recovery. We have introduced two state-of-the-art hybrid vessels on the English Channel, opened a new North Sea route and expanded our fleet, and are now on the path to operational profitability.”

P&O has never been state-owned, but their cross-channel ferries are part of the UK’s logistic infrastructure especially when it comes to freight. And they don’t just constantly cross the channel to France but service ferries to Ireland, Belgium and the Netherlands. With new Government regulations protecting workers’ rights, around £400m in loans from DP World to service and the usual cocktail of costs that include fuel and energy hikes – and the £47m it cost to sack 800 workers – the company remains in jeopardy with insolvency not impossible.

ICSM CREDIT

For information on ICSM visit www.icsmcredit.com or call 0844 854 1850.

ICSM, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR. Tel: 0844 854 1850. www.icsmcredit.com. Ian.carrotte@icsmcredit.com

You must be logged in to post a comment.